Co-ownership of a farmhouse at San Martino in Badia

150 sqm

6

4

2

Price on request

San Martino in Badia - Center

3812

Key data

General information:

Category:

Villa / House / Farm

Kind of property:

farmhouse

Contract:

Purchase

Purchase price:

Price on request

Apartment for residents:

no

Orientation:

O

Lift:

no

Area & Facilities:

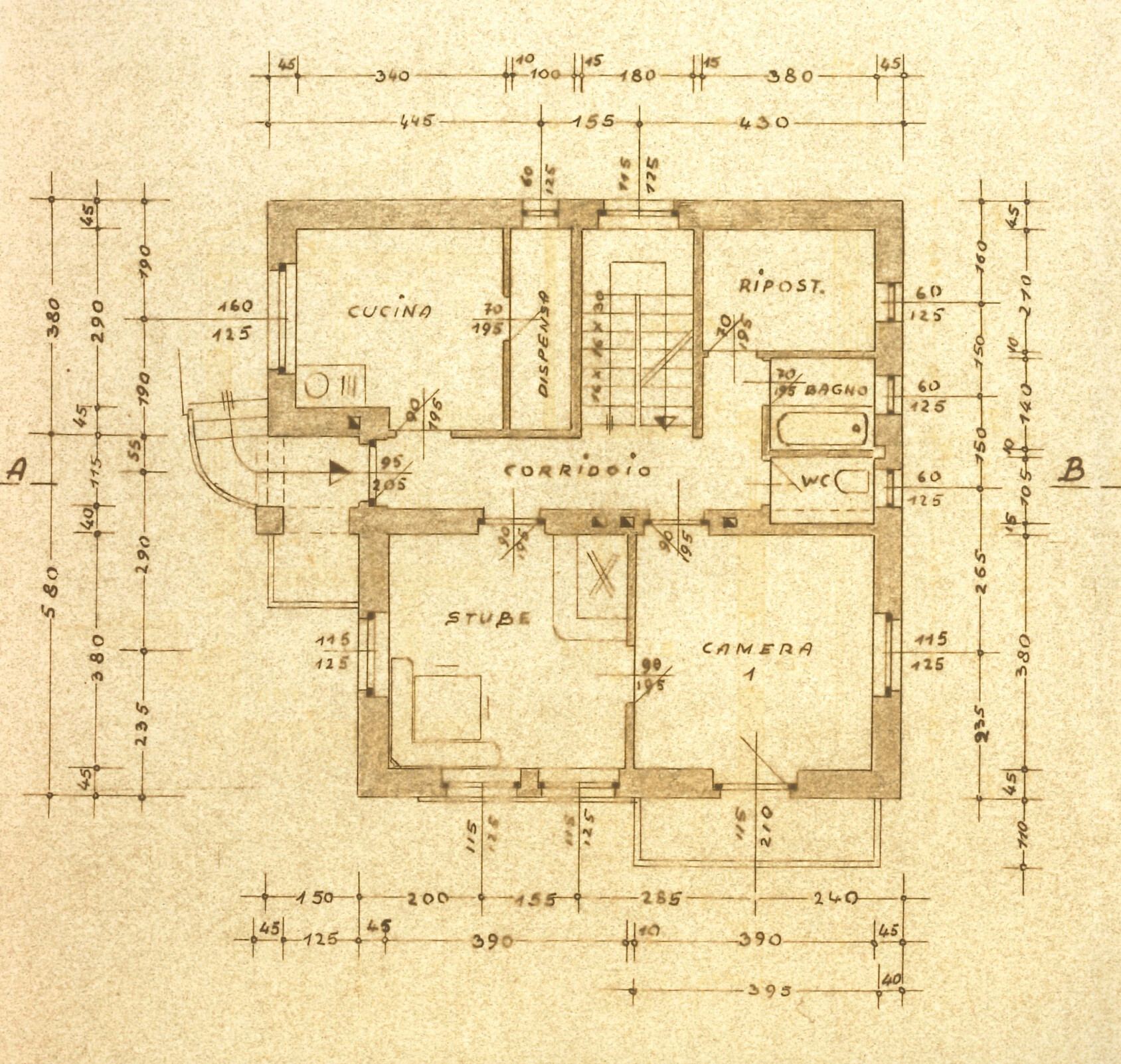

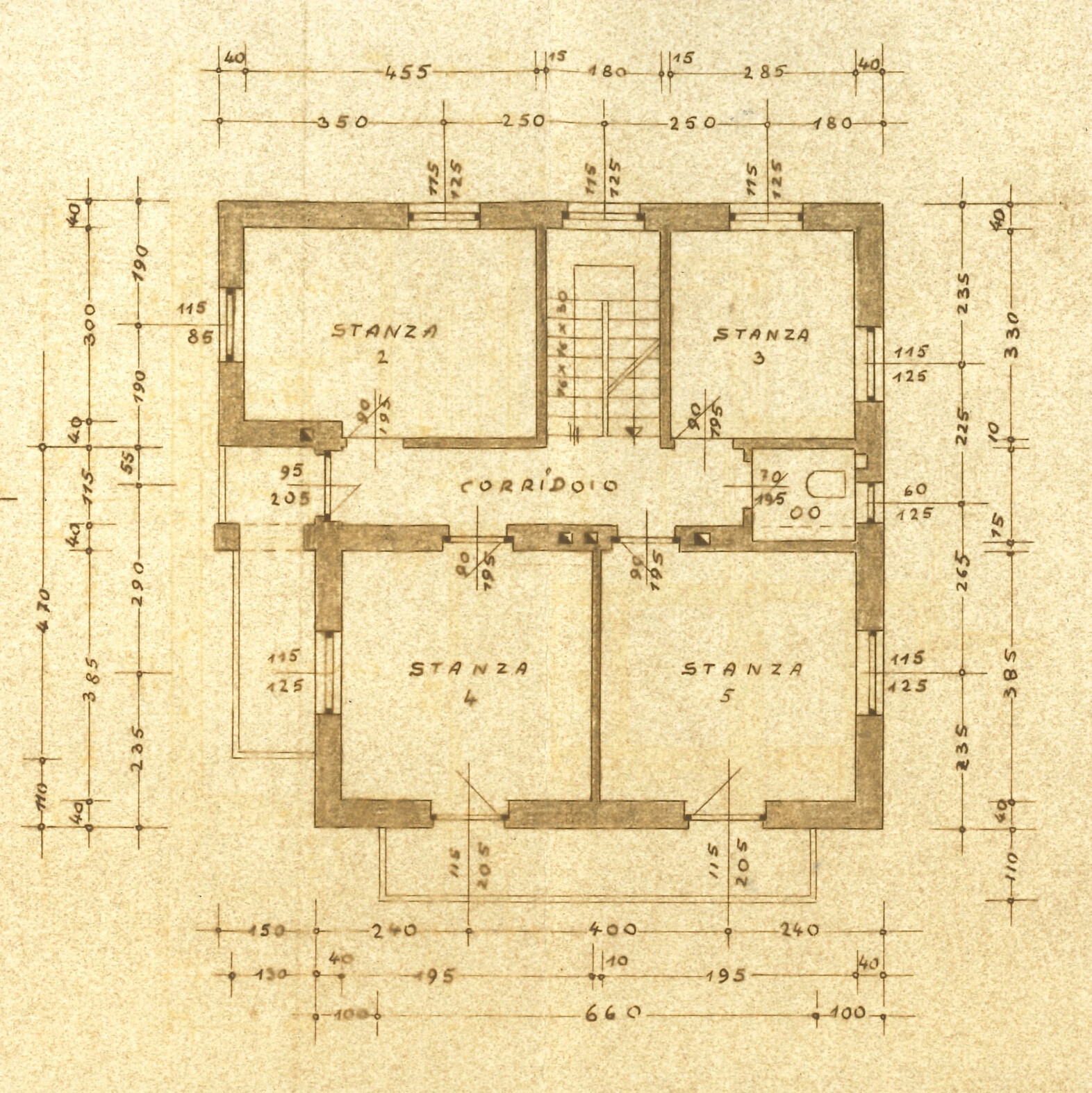

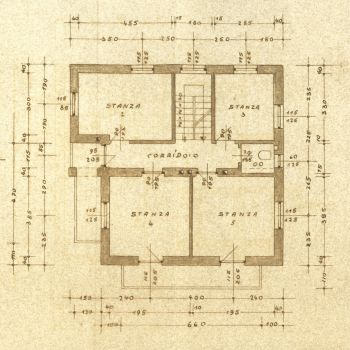

Net living area:

150 sqm

Sales area:

210 sqm

Terrace/ Balcony area:

13 sqm

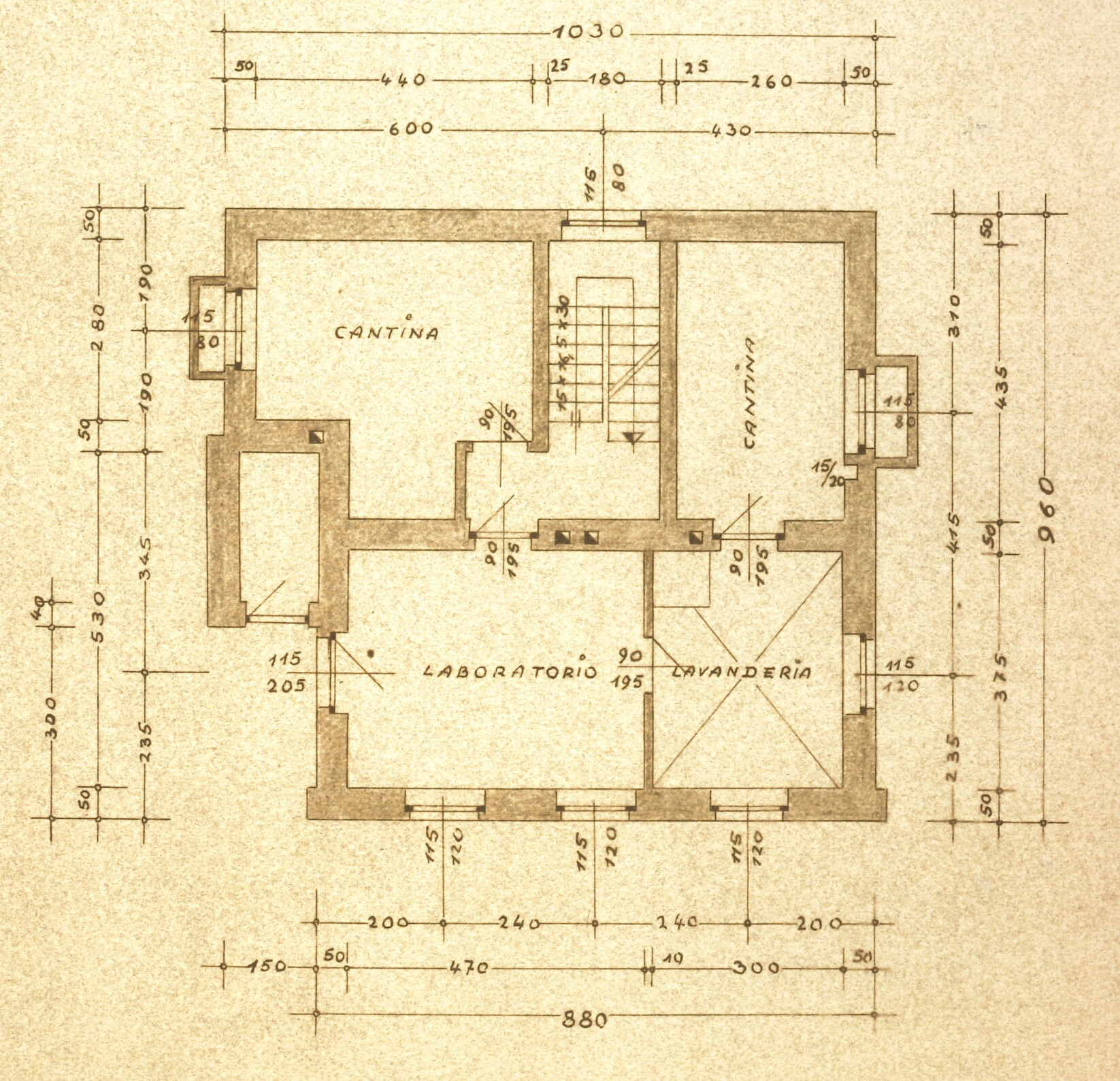

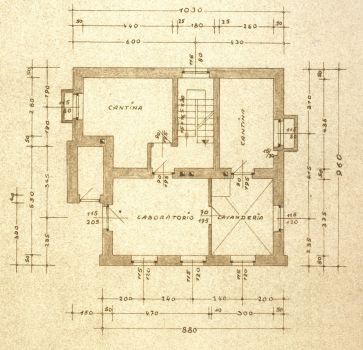

Area cellar:

30 sqm

Rooms:

6

Bedroom:

4

Bathroom:

2

Condition & energy efficiency:

Year of construction:

1960

Object state:

in need of renovation

Energie source:

Wood

Type of heating:

furnace heating

Energy class:

G

Description

For sale is only an undivided co-ownership of 50% of the property of the whole farm. Without permission of the other co-owner the property can non be used.

This farm in San Martino in Badia consists of a residential building in need of renovation and a barn next door.

Furthermore, various forests and meadows belong to it, which are included in the price.

ST. MARTIN IN THURN

The commune is located in the Val Badia, includes the villages of Pikolein, Campill and Untermoi and has about 1,700 inhabitants.

The local mountain of St. Martin in Thurn is the famous Peitlerkofel.

For culture lovers, the Ladin National Museum Ciastel de Tor is definitely worth a visit.

In winter, skiers can reach the Sellaronda slopes by shuttle service and also the Kronplatz is only 1 km away.

Location

Information

Taxes

The buyer always pays the taxes for the real estate assignment. It is distinguished as follows:

Purchasing from a private person:

If the property is purchased from a private person or an entity not subject to VAT, the registration tax must be calculated based on the cadastral value:

- First/primary home: 2% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

- Secondary/holiday home: 9% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

Purchasing from companies:

If the property is purchased from a company, which is subject to VAT, the general Value added Tax (VAT) applies:

- First/primary home: 4% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Secondary/holiday home: 10% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Luxury property: 22% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

In addition to the taxes, there are notary fees for the notarisation of the preliminary purchase agreement or purchase contract. These vary according to the price of the property to be transferred and depend on whether the contract is drawn up in one or two languages.