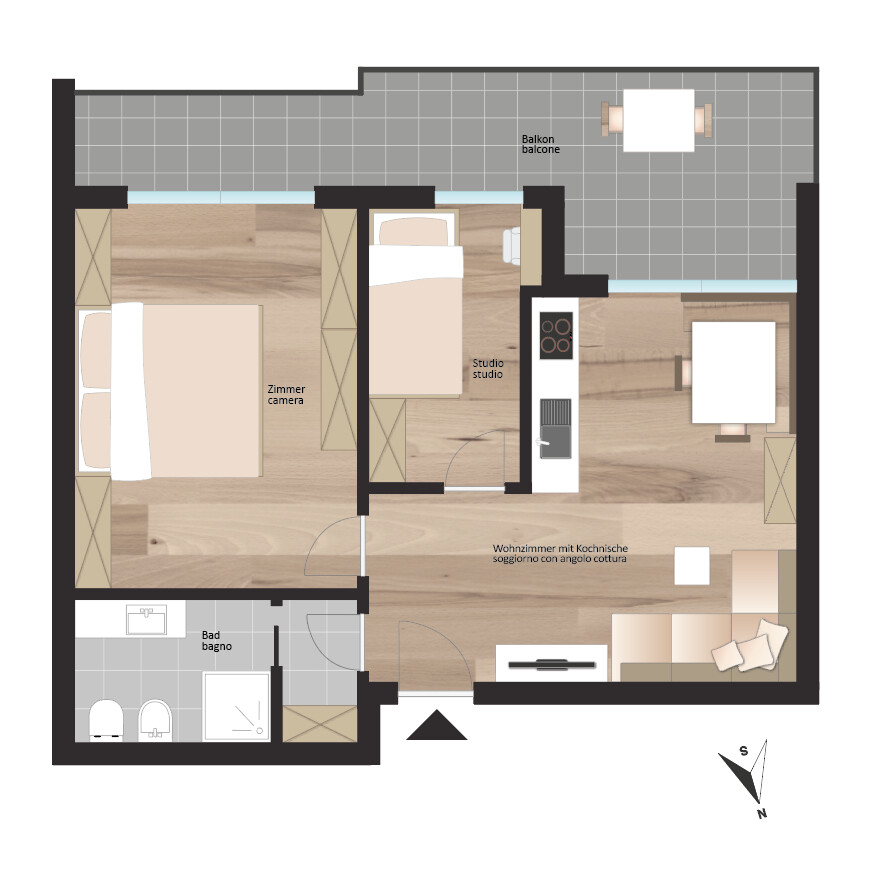

2-room apartment with castle view in a quiet location

46 sqm

2

1

1

Price on request

Brunico - Center

5298

Key data

General information:

Category:

apartments

Kind of property:

apartment

Contract:

Purchase

Purchase price:

Price on request

Apartment for residents:

no

Floor:

2

Orientation:

S

Lift:

no

Furniture:

part furnished

Area & Facilities:

Net living area:

46 sqm

Sales area:

approx. 60 sqm

Terrace/ Balcony area:

14 sqm

Area cellar:

4 sqm

Rooms:

2

Bedroom:

1

Bathroom:

1

Condition & energy efficiency:

Year of construction:

1981

Object state:

used

Energie source:

District heating

Type of heating:

radiator

Energy class:

G

Energy consumption:

213 kWh/(m²a)

Description

Ideal as a main residence or stylish vacation apartment in South Tyrol - for relaxing breaks in a top location close to the Plan de Corones ski area and the charming old town of Brunico.

Brunico - the heart of the Pustertal Valley - is a versatile residential and vacation resort in South Tyrol. The historic old town with its charming alleyways, first-class restaurants and diverse shopping opportunities attracts visitors all year round. Surrounded by the Dolomites and just a few minutes away from the Kronplatz ski area, Brunico is the perfect starting point for hiking, skiing and relaxation. With its high quality of life, modern infrastructure and attractive real estate, Brunico is ideal for anyone looking to live or invest in South Tyrol.

Information

Taxes

The buyer always pays the taxes for the real estate assignment. It is distinguished as follows:

Purchasing from a private person:

If the property is purchased from a private person or an entity not subject to VAT, the registration tax must be calculated based on the cadastral value:

- First/primary home: 2% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

- Secondary/holiday home: 9% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

Purchasing from companies:

If the property is purchased from a company, which is subject to VAT, the general Value added Tax (VAT) applies:

- First/primary home: 4% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Secondary/holiday home: 10% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Luxury property: 22% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

In addition to the taxes, there are notary fees for the notarisation of the preliminary purchase agreement or purchase contract. These vary according to the price of the property to be transferred and depend on whether the contract is drawn up in one or two languages.