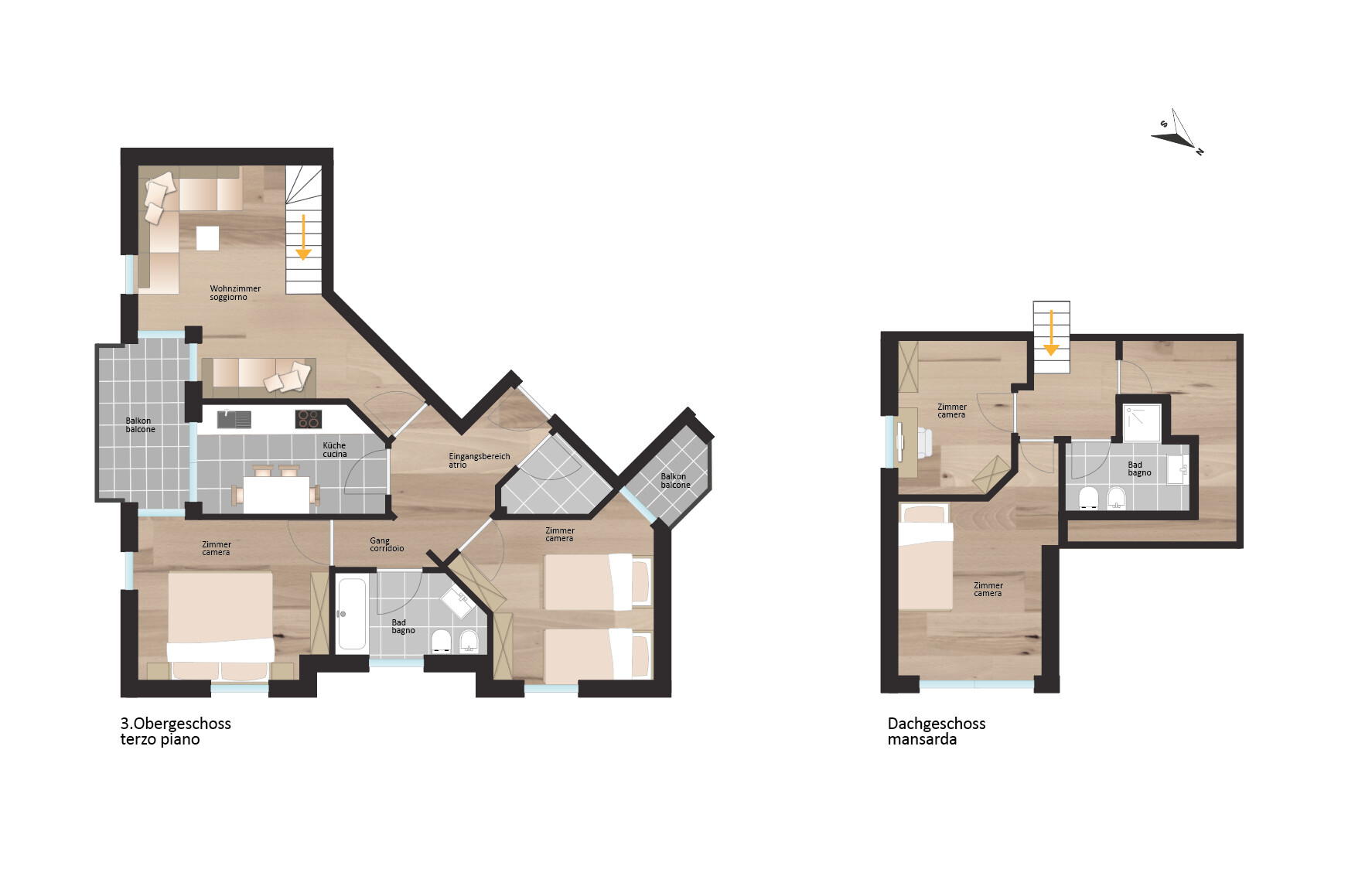

Renovated 4-room apartment in a central location

108 sqm

4

3

3

750.000 €

Brunico - Center

5189

Key data

General information:

Category:

apartments

Kind of property:

duplex apartment

Contract:

Purchase

Purchase price:

750.000 €

Apartment for residents:

no

Floor:

2

Orientation:

W

Lift:

yes

Furniture:

unfurnished

Area & Facilities:

Net living area:

108 sqm

Sales area:

approx. 133 sqm

Terrace/ Balcony area:

6 sqm

Area cellar:

4 sqm

Rooms:

4

Bedroom:

3

Bathroom:

3

Condition & energy efficiency:

Year of construction:

1995

Property renovated:

2024

Object state:

used

Energie source:

District heating

Type of heating:

floor heating, radiator

Energy class:

C

Energy consumption:

140 kWh/(m²a)

Description

On the first of the two floors there is a spacious living room, a separate kitchen, two bathrooms, two bedrooms and two balconies.

The living room leads to the top floor where there is a bedroom, a bathroom, a study and a storage room.

On the 1st basement floor there is a garage parking space and a cellar compartment.

The apartment is rented.

The city of Bruneck is located in the heart of the Puster Valley, at the foot of Kronplatz. Not only geographically, but also culturally is Bruneck the center of the Puster Valley.

The Castle of Bruneck offers stunning views over the city's rooftops.

The Old Town of Bruneck is located approximately in the center of the municipality, at the foot of the Schlossberg.

For guests there is a famous Christmas market in winter every year.

Information

Taxes

The buyer always pays the taxes for the real estate assignment. It is distinguished as follows:

Purchasing from a private person:

If the property is purchased from a private person or an entity not subject to VAT, the registration tax must be calculated based on the cadastral value:

- First/primary home: 2% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

- Secondary/holiday home: 9% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

Purchasing from companies:

If the property is purchased from a company, which is subject to VAT, the general Value added Tax (VAT) applies:

- First/primary home: 4% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Secondary/holiday home: 10% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Luxury property: 22% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

In addition to the taxes, there are notary fees for the notarisation of the preliminary purchase agreement or purchase contract. These vary according to the price of the property to be transferred and depend on whether the contract is drawn up in one or two languages.