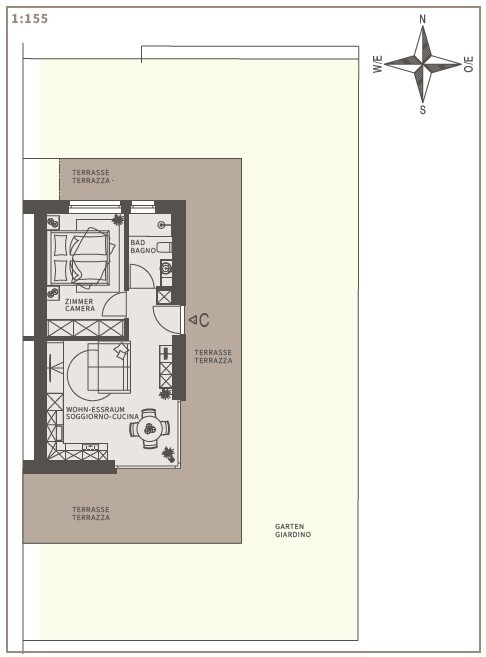

2-room-flat with garden (C)

38 sqm

2

1

1

420.000 €

Dobbiaco - Dobbiaco Nuova

5151

Key data

General information:

Category:

apartments

Kind of property:

ground floor apartment

Contract:

Purchase

Purchase price:

420.000 €

Apartment for residents:

no

Floor:

0

Lift:

yes

Furniture:

unfurnished

Area & Facilities:

Net living area:

38 sqm

Sales area:

approx. 87 sqm

Terrace/ Balcony area:

48 sqm

Garden area:

140 sqm

Area cellar:

7 sqm

Rooms:

2

Bedroom:

1

Bathroom:

1

Condition & energy efficiency:

Year of construction:

2025

Object state:

first time use

Energie source:

District heating

Type of heating:

floor heating

Energy class:

A+

Description

The apartment is located on the first floor of a new building project and consists of an entrance area, a living room with kitchenette, a bedroom and a spacious terrace with garden. A cellar room offers additional storage space. Garages can be purchased at an additional cost of €35,000 + VAT.

Don't miss the opportunity to make this charming first floor apartment your own home. You will not only acquire a first-class property, but also a piece of quality of life in picturesque Dobbiaco.

The apartment can be used as a secondary or vacation home.

The municipality of Dobbiaco is located in Alta Pusteria in South Tyrol. The "gateway to the Dolomites" borders on the Three Peaks Nature Park in the Sesto Dolomites and Fanes-Sennes-Braies and is home to two important bodies of water, Lake Dobbiaco and Lake Dürrensee. The municipality of Dobbiaco includes not only Old and New Dobbiaco, but also the villages of Aufkirchen, Wahlen and Silvestertal.

Sights include the legendary Herbstenburg castle and the 5 Passion chapels along the Maximilianstraße, which are part of the oldest Way of the Cross in Tyrol. An excursion along the disused railroad line into the Höhlenstein Valley, a walk along the Toblacher See nature trail or a tour along the Höhenweg trail will show you the most beautiful side of Toblach.

Information

Taxes

The buyer always pays the taxes for the real estate assignment. It is distinguished as follows:

Purchasing from a private person:

If the property is purchased from a private person or an entity not subject to VAT, the registration tax must be calculated based on the cadastral value:

- First/primary home: 2% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

- Secondary/holiday home: 9% registration tax, fixed mortgage tax (€ 50.00) and fixed land registry tax (€ 50.00).

Purchasing from companies:

If the property is purchased from a company, which is subject to VAT, the general Value added Tax (VAT) applies:

- First/primary home: 4% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Secondary/holiday home: 10% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

- Luxury property: 22% VAT, fixed registration tax (€ 200,00), fixed mortgage tax (€ 200.00) and fixed land registry tax (€ 200.00).

In addition to the taxes, there are notary fees for the notarisation of the preliminary purchase agreement or purchase contract. These vary according to the price of the property to be transferred and depend on whether the contract is drawn up in one or two languages.